Why company “governance” may not be so boring after all 😉

“Governance” is for any size company, and how well governance is carried out can affect company success.

If there is a Board of Directors, then overall governance is the Board’s responsibility. If there is no Board – common in smaller companies – then governance is still needed but is fully the responsibility of company owner(s)/leaders.

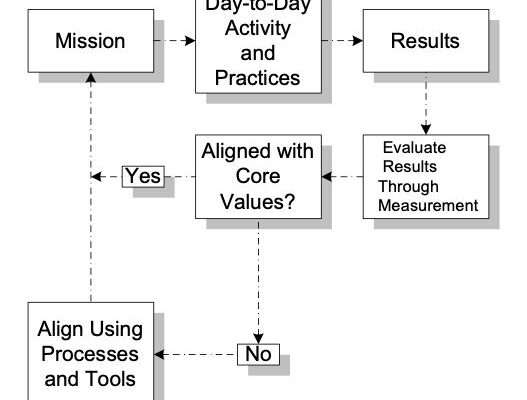

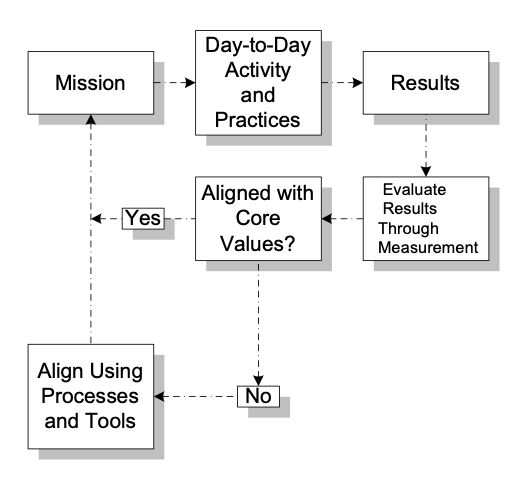

The triumvirate of mission, values, and vision is the foundation for any effective company and for effective governance. A clear picture of mission and values guides establishing vision and evaluating progress.

In a recent insight, we looked at the how any company can implement values more effectively and demonstrated in everyday work.

This time, let’s look at how to ensure meaningful results for key company stakeholders.

For long-term success, a company must balance needs and success of three basic stakeholder groups: customers, employees, and owners/shareholders. A company cannot exist for long without customers, employees to effectively serve the customers, and company finances that allow the company to serve those customers and employ those employees.

Adding a fourth group makes sense for most: any significant other stakeholders to which the company is committed to a mutually beneficial relationship.

We now have, as Blanchard and O’Connor termed in their book Managing By Values, the “C.E.O.S.”:

- Customers,

- Employees,

- Owners/Shareholders, and

- Significant other stakeholders.

The ”S” is where communities, key vendors, environmental concerns, etc. would go if desired … including the “E” and “S” in ESG (Environmental, Social, and Governance). A company can elevate one of these separately to the level of C.E.O.S., but that must not detract from business basics. Definitely don’t have two separate planning, tracking, and evaluation processes … this would lead to confusion and dilution.

The C.E.O.S. factor into governance in many ways.

- One way at the strategic level is a cross-check against company values. Do the values provide benefit across the C.E.O.S. or primarily one stakeholder category?

- Another top-level check is against strategic plans. Do plans and related metrics target all the C.E.O.S.? Some or one group? If the latter, is this temporary to rebalance or is a rethink needed of company focus?

- Tactically, projects can be checked against the values and C.E.O.S. And values should certainly apply to performance management.

There are many ways that values and the C.E.O.S. should be woven into the company’s being.

More in the next insight.

📩 If you’d like information like this via email instead of the hit or miss of social media, send me your email and I’ll add you to the list.

👉 Need help with making your company governance more effective? Contact us to discuss how to do that.